Stride, Inc. (LRN): Temporary Tech Issues, Attractive Opportunity in this School-as-a-Service Leader

Also a $500m Stock Buyback Authorization on the way.

Background

Founded in 2000 as K12 Inc., Stride was a pioneer in the “school choice” ideals of the time, built on providing high quality virtual alternatives to the traditional public school education. In the early 1990s the idea of independently operated charter schools has been conceptualized which has paved the way to a business like K12, Inc. The company’s roots were on the political reform of public education but transformed itself over the years into the complimentary “School-as-a-Service” model that we see today.

The company today primarily contracts its proprietary infrastructure, curriculum and licensed teaching staff to non-profit charter school boards and local school districts backed by state and local government funding.

Beyond the K-12 core, Stride heavily expanded into the Career Learning portion of its business in the last couple of years that provides students and adults with learning resources to earn certifications and upskill in high demand fields like IT, Healthcare and Data Science.

Business Figures & Ratios (12/19/2025)

Price: $66.08

Market Cap: $2.8b

P/E: 10.42x

EV/EBITDA: 4.49x

EV/FCF: 8.76x*

*Enterprise Value / (CFO - Stock Comp - PP&E - Capitalized Software/Curricumlum)

ROCE: 21%

Rev Growth: 3%-5%

Business Overview

Stride today has two primary businesses: General Education and Career Learning.

General Education (60% of total FY 2026 Revenue) is the primary business the company has been known for from its founding. The managed public school model contracts with non-profit charter school boards and local school districts. A state or local district may authorize a virtual charter school, then the board of that school would hire Stride to provide the technology infrastructure such as the curriculum, the learning management system (LMS) and potentially administrative and marketing services to finds students likely as some value-add services. Stride through K12 has a centralized locator for families to search online through the schools the company is contracted with their services.

The funding for these services come from state and local tax dollars on a per-enrollment/student basis. The student enrolls in the virtual charter school, the funding originates from the local district to the virtual school and then Stride takes a percentage cut for managing the operation.

Stride can also leverage its existing platform and technology to vendor itself out to the traditional brick-and-mortar school districts. A local school perhaps may want to offer some virtual/hybridized options and may not have the resources, talent and/or experience to build these models from scratch. They can contract out with Stride to create licensed curriculum and maybe perhaps hire Stride’s virtual teachers as a form of professional services. In some cases they may want to create their own online schools entirely.

From my view and research these are extremely sticky reoccurring revenues that could have very high costs to switching if there is even truly an alternative service comparable to Stride. The average contract with these customers is around 5 years in length and they have over 90% retention rate.

It’s comparable to customizable/semi-customizable software from other public facing technology companies like tax preparation, bookkeeping, payroll processing, CRM etc., the kind of software that does the “dirty work”, employees get used to it, they know what buttons/prompts to press for it to do the thing they want, gets deeply embedded into the daily operations of an organization that may make it very hard to get it out once its rooted in.

On top of all of that it has the bluest chip funding source which is state and local government backed by taxpayer funds.

Career Learning (40% of total FY 2026 Revenue) is a newer line of business that was created as a result of over $172m dollars worth of acquisitions in Galvanize, Tech Elevator and MedCerts, LLC in 2020. This business augments their current K-12 business in the following ways:

Fulfill training and education needs for high growth career paths in the IT and medical fields for adults pursuing nontraditional education path or just to upskill at their current experience and education.

Create more value-add services within the Middle School/High School part of their K-12 business with college prep curriculum, college credit courses and guiding students towards high growth economical career paths.

Open the doors to corporate training and training sourcing services.

Career Learning opens a lot more doors for the company in leveraging their current partners to increase value in the education pipeline.

Management

The two most important figures in Stride’s recent history has been former CEO/Chairman Nathaniel Davis and current CEO/Chairman (Former CFO) James Rhyu. They really were more business people who took control of a company run by education people essentially. Nate took the reigns to grow the business organically via their general education business and inorganically through the 2020 acquisitions prior to his retirement.

James Rhyu who has been at the company since 2013 through various capacities was to succeed him for some time, working through some sort of a transition phase prior to the change being public in 2021. I would read the transcript from the company’s 2023 investor day (You can read on Tikr or listen to the audio on Quartr, I can’t find it anywhere else) if you want to understand how he views the business but one of the pieces I found interesting:

This quote below was interesting regarding Stride paying for remediation for students who’s been with them from K to 3rd grade failing to be able to read effectively:

Last quote is regarding why some of the top companies are successful:

There’s a little bit of a Jeff Bezos type of obsession with the “customer” in this case that you don’t see that often. I think you have to at the end of the day if this is suppose to be more effective and competitive with brick-and-mortar public schooling. The bar is really low but I think management wants to do more than just beat public schooling satisfaction ratings by a single point.

Financially, it was very apparent that James from the CFO role to the CEO role he had a strong cost conscious influence as over time as SGA as a % of Revenue went from 33% in FY 2017 to 20% today. Now to be fair, there’s probably a lot of scale advantages as the company grew but the company started to track this percentage figure in recent years. The result of this change has created a tremendous amount of value in improving operating margins.

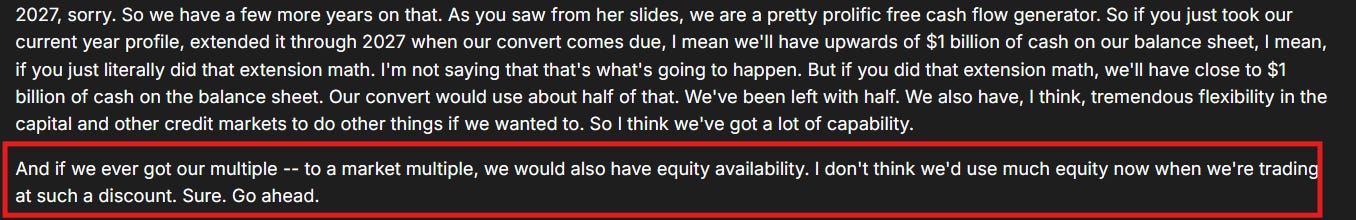

I also think James is very aware of capital allocation and the intrinsic value of the company. He somewhat gives it away here at the 2023 Investor Day:

Stock was trading around $30-$40 per share when this event would have happened.

Last note, there’s not a lot of insider ownership within the management team. James owns the most around 1.7% of the outstanding shares:

Still large enough dollar wise that I don’t think I would put his incentives in question.

Investment Thesis

The investment thesis is simple for this company. You are buying a “School-as-a-Service” leader that earns basically a “royalty” from state and local school districts for the use of your education technology infrastructure to improve student experience and outcomes. I find this to be a high quality company, with a durable business model, high retention rates and first movers’ advantage with no true alternative or competitor to what Stride, Inc. does. Pearson’s Connections Academy is the closest competitor and I’m not 100% sure if it is comparable to the scale Stride is already operating currently.

I find the opportunity to be fitting for where the timeline is for the company. Where a lot of cash historically was plowed into the business and in acquisition augmentation. Today there is a lot of cash being generated, they are returning above average returns of equity and capital is starting to be returned to shareholders. There’s that potential for the “Davis Double-Play” where the EPS will grow via business growth and share repurchases, AND through potential multiple expansion from today’s price. Lastly, I believe the management team is an above average one given their recent history partially discussed in the previous section.

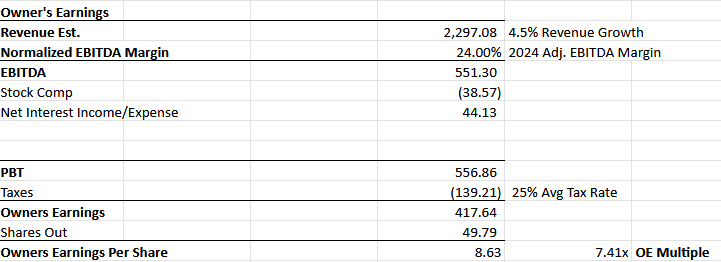

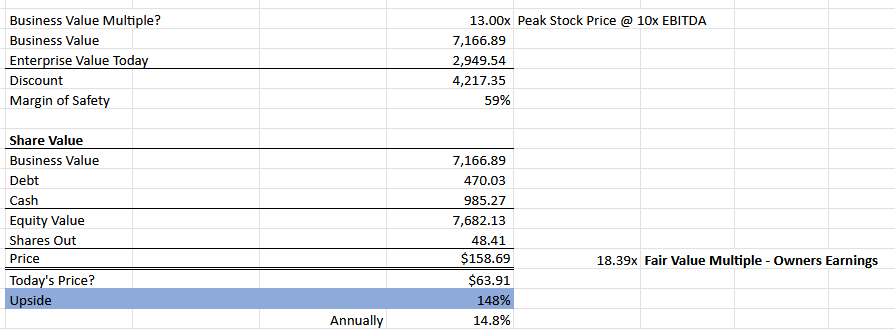

At today’s stock price you can purchase the stock at around 7.41x Owners Earnings based on a 4.5% revenue growth for FY 26 on 24% EBITDA Margin. I think the business is worth at least around 18x Owners Earnings multiple or P/E Multiple which puts it at around $158/share which is just under 15% return per year. There is also $500m stock repurchase plan announced by the board which is about 14% yield on today’s stock price adjusted for stock comp that would dilute the repurchases.

Why Does This Opportunity Exist?

Technology Implementation Issues: The company had made investments and improvements in their technology based learning platforms when implemented/deployed was negatively received by their customers. It caused the company to lose around 10,000-15,000 enrollments. With 234,000 enrollments on FY 2025 numbers that is around a 5%-6% of its current base.

For-Profit Education Label: There’s been a number of cases such as DeVry University and University of Phoenix in higher education that had very public lawsuits over their marketing practices and accreditations that has made any idea of a for-profit company serving the education industry a difficult idea for investors.

Other: There’s a few other potential reasons such as stock comp/share dilution, company’s acquisition history and political risk. To be honest I’ve worked back on these items and these reasons just didn’t really pass the sniff check. Stock comp makes up about 11% of FCF, share dilution has been around 1%-3% historically vs the high growth of the revenues. Lastly the acquisitions looked questionable at the time but it did generate around $3.2b sales in the Career Learning segment from FY 2020 to date on $172m worth of acquisitions.

Risks:

Political Risk: Stride’s business revolves around the idea of school choice and mixed in with public perceptions on charter schools and/or for-profit education there is some risk here. Additionally the company has to be very careful on any narratives or comments that are politically sensitive.

Stock Comp/Dilution: I wouldn’t rule this out for a really large acquisition using stock, but this could be a risk that could destroy value depending if shares used when the company is undervalued vs at perhaps above 20x earnings for example. Like mentioned above, there’s some stock comp involved, I think they will grow at a rate that will make this really unnoticeable for investors, especially with a stock buyback program now in place.

Permanent Operation Issues: This may be one of the most worrying ones is what if the technology implementation issues are more structurally permanent issues with the company? I don’t see anything that would tell me this is anything but a poor deployment or upgrade of their current platform/technology that they just need to patch up.

Conclusion

I think this is one of the more interesting business models I’ve come across in the companies I have covered. I didn’t want to go the “hidden champion” route but I always wonder if this company that is the biggest in its niche, who actually is aware of this company outside of some parents and educators? It was probably more true prior to the Career Learning business being stood up that has more B2C exposure.

I’m particularly surprised how much of an open field this is for a single player to just capture an entire market. Since I mentioned Jeff Bezos above, at some point he mentioned how AWS had a 7 year head start before Microsoft and Google entered the market. Does Stride have 7 years to dominate this market before people start noticing the returns and economics of this business? I don’t know but it wouldn’t surprise me if it continues to be unnoticed for a while longer. Great business in an odd/disliked industry tends to do really well for investors.

Disclosure: I own a long position LRN. I am not short on any positions mentioned in this post. I may add to my long positions over time. I only manage my own personal accounts and do not manage outside capital. Nothing here is a recommendation to buy or sell securities, please DYODD.

Strong writeup on the SaaS-for-education angle. The retention dynamics you highlighted are key - switching costs in education aren't just about tech integration but literally disrupting a child's continuity of learning, which creates a different type of moat than typical B2B software. The tech deployment mishap losing 5-6% of enrollment is concerning but the fastthat districts didn't flee entirely suggests the core value prop holds. I've seen similar situations in edtech where implementation fumbles get smoothed over if the underlying platform actually solves a real problem. The AWS comparison is apt tho, theres a first mover window here that wont last forever once people realize the unit economics.

Nice article I’ve looked at this a decent amount after its recent drop. I think it’s likely to perform satisfactory from these levels. As a public math teacher in a previous life I think the wind is at their back, should be able to grow for a long time. My biggest concern with the stock is how good is the material are kids actually learning? It shouldn’t be that hard to create curriculum that smart students would excel at, if they can do that there would be a lot of value added to the country.

If you get a lot of not so good students who aren’t going to try could make test scores look pretty bad all online. Wouldn’t be Strides fault these kids would struggle in traditional schools.

Long story short if they create good content this thing can really go.